Posted Oct 2, 2022, 4:08 PM

It’s a good thing done, but not necessarily the right signal yet. The Great American Stock Index S&P500 experienced its third consecutive quarter in decline, unheard of since its six consecutive quarters in the red, during the great financial and then economic crisis of 2007-2009.

Natixis experts, however, consider the “directional” still negative for equities, citing deteriorating liquidity, tight monetary and financial conditions, a deterioration in fundamentals on the corporate side, linked to the imminent recession in the euro zone. .

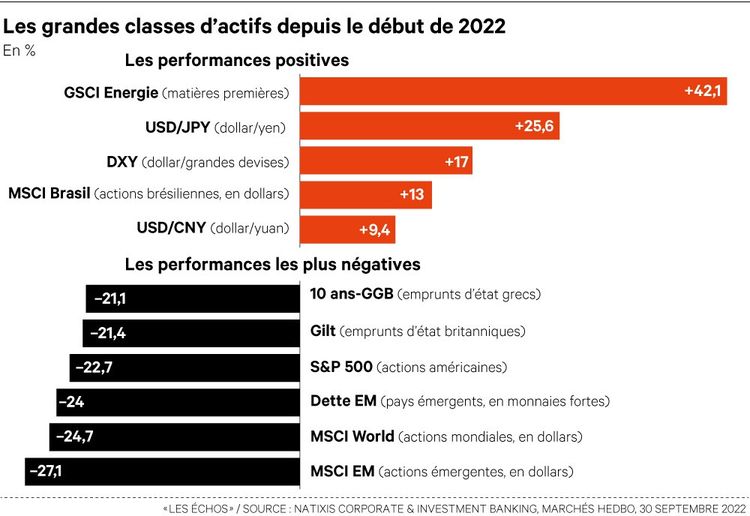

After the panic over the British debt, curbed by the Bank of England, they do not hope that the latter will be emulated because inflation is still not giving up. The performances of the asset classes also reflect the decline in the United Kingdom.

To note

The negative performance of Gilts _British government bonds_ deteriorated in one month (-21.4% since the start of 2022 against -11.2% at the end of August). The deterioration is more marked than that of T-Notes (-15.1% against -10.2% a month earlier) or OATs (-15.2% against -10.3%), US government bonds and French respectively.

What benchmarks in a constantly changing world?

Political uncertainties, scientific innovations, war in Ukraine, energy and ecological transition… How to understand these changes? How to position yourself? Every day, the 200 journalists from the “Echos” editorial staff help you decipher economic, political and international news through surveys, analyses, press reviews, chronicles and editorials. Our subscribers know that they can rely on these resources to better navigate our complex environment and make the best strategic decisions.