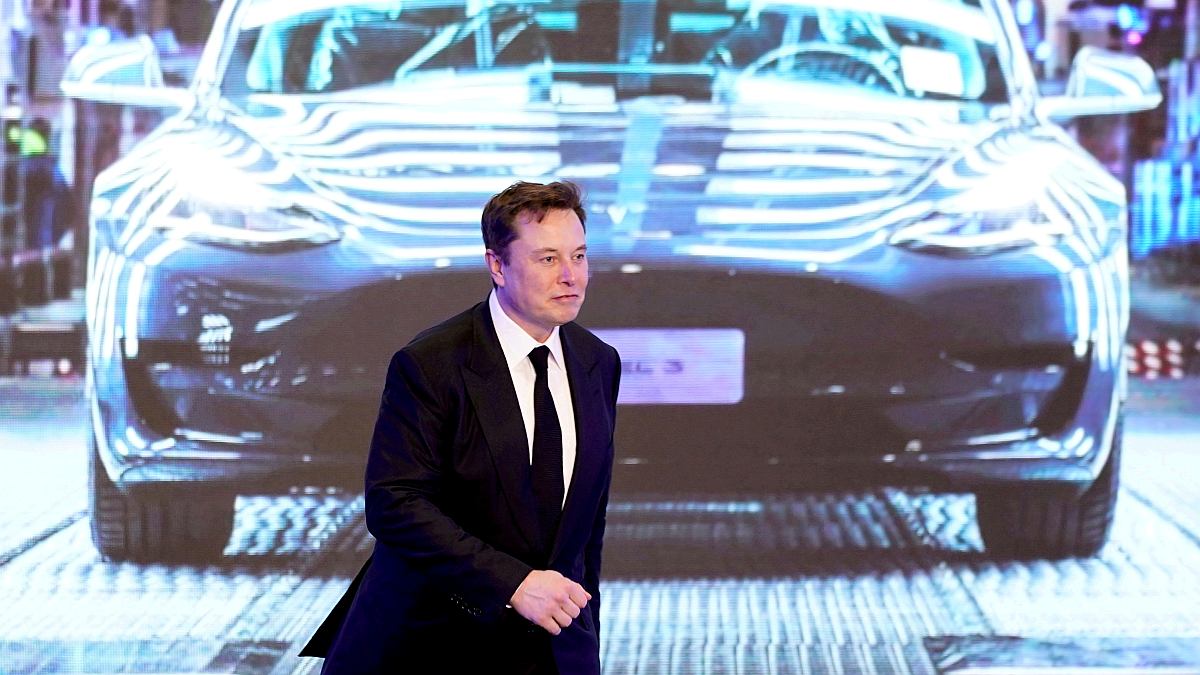

Elon Musk says a lot of money could be made by turning raw lithium into battery chemicals, but shrinking profit margins suggest the mining end of the business may still be a better bet. Musk last month described lithium refining as the difficult part in the complicated process of getting the raw materials off the ground and into Tesla Inc.’s cars. For those who can crack it, it is a “license to print money”, he said. And he was right: Margins soared earlier this year, as fast-moving orders from carmakers led to record increases in prices for specialty chemicals produced by “merchant refiners” — companies that buy and process materials from lithium producers. Huh.

But if the price of the raw materials rises faster than the price of the lithium chemicals they sell, the refiner’s profits could run out quickly. While China’s COVID lockdown has weighed down demand for finished products from battery and automakers in recent months, the price of mined raw materials continues to rise.

As a result, profit margins at lithium plants have been reduced. According to Fastmarkets, which tracks prices for lithium products and other commodities, processors are still making historically strong earnings, but margins have fallen by more than half from March’s peak.

The reversal is a reminder of how refiners – and the entire electric-vehicle supply chain – are at the mercy of miners and their ability to quickly bring in new production to meet rapidly growing demand. Delayed supply reactions are common in other commodity markets, which is why the lion’s share of profits are usually made in mining, not refining.

“Merchant refining can be a very scary place in any commodity market, because you can squeeze on both ends,” said Peter Hanna, a senior value development manager at Fastmarkets. “I don’t think these margins will be a long-term feature of the market.”

Meanwhile, the producers continue to earn big. Chile’s SQM, the second-largest supplier, posted a record quarterly profit late Wednesday and said it expects prices to remain high for the rest of the year.

While Musk’s comments have put lithium refiners in the limelight, Tesla and other carmakers remain cautious about the risk of prolonged mine-supply shortages. Car manufacturers including Ford Motor Company. And General Motors Co. has been signing long-term supply deals for battery metals with both miners and processors in recent months, as price increases underscore the risk that EV expansion plans without access to adequate raw materials can stop.

In a strategy that goes against the grain of the industry’s traditional on-time procurement practices, they are now increasingly dealing directly with miners, even in cases where projects are far from production. Huh.

“There is no shortage of lithium, but there are not enough projects that will be running in time to meet demand in that time frame,” said Max Reid, a battery raw materials analyst at Wood Mackenzie. “We are confident that the deficit will begin to peak in 2030, mainly due to a lack of new investment in the early part of this decade.”

Tesla has taken the lead in shifting the industry’s approach to sourcing by buying mining rights in Nevada in 2020.

With prices of lithium chemicals at higher levels and prices of the mining raw material known as spodumene rising, Musk has signaled a move forward — going so far as to give the industry an ultimatum on an investor call last month. .

“If our suppliers don’t solve these problems, we will,” he said.

© 2022 Bloomberg LP