Posted Oct 3, 2022, 7:13 PM

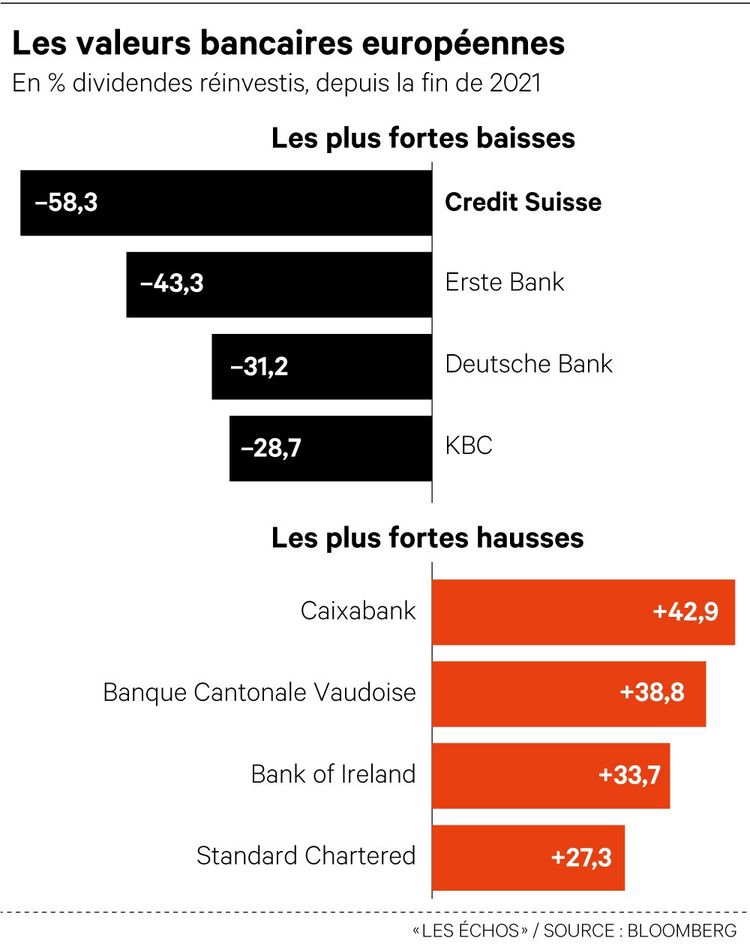

“In the stock market, you have to buy the rumor and sell the news”. Without any originality, the price of Credit Suisse bond debt insurance _CDS or “credit default swap” _ therefore soared, and this increased risk premium weighed on the share price. The first is found above the historical peak of 2009, during the great financial crisis. And the second now shows a drop of close to 60% in nine months.

Speculators in search of easy thrills know that the new management in charge of raising the bar _after the errors of governance and the succession of scandals_ was to say more about its restructuring plan, at the end of the month. Rumors of a capital increase had already been denied by the banking logo with two veils.

It was shortly before the bond hurricane across the Channel. It will not facilitate disposals and it has reignited rumor mills on liquidity. Going to the trouble of reassuring large customers about the safety cushions on the balance sheet has given them wings. But in the age of twitteratti, silence would not have been golden either vis-à-vis wealthy customers.

Financial rating

Experts in bond fundamentals know how not to rely too much on expectations of an illiquid market like that of CDS.

They also know that a financial note under a negative outlook, like that of the second largest Swiss bank, can fuel self-fulfilling phenomena.

How to react effectively to changes?

Economic uncertainties, political tensions, global warming, changing businesses and industries… The world is changing. How to decipher weak signals, anticipate and best adapt? The “Echos” editorial staff, with its 200 specialized journalists, provides you with strategic thinking tools every day to understand our environment and deal with changes. Through our analyses, surveys, chronicles and editorials, we support our subscribers to help them make the best decisions.