Posted Oct 3, 2022, 5:05 PMUpdated Oct 3, 2022, 5:19 PM

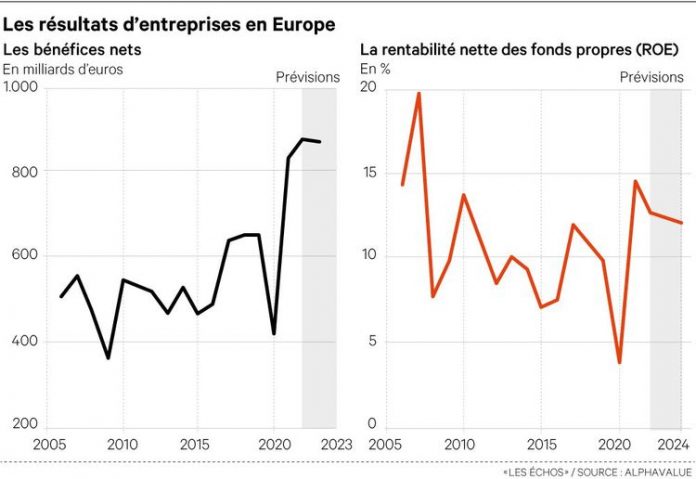

The look in the rear view mirror, although offering only a vision of the past, often remains instructive. The 890 billion euros of cumulative adjusted net profit, group share, expected this year by AlphaValue for 553 listed European companies covered will only mark a record in sham.

For the design office, the returns on equity (RoE), after taxes, are more meaningful. At 12.7% expected this year on a weighted average, they are far from the peak of 2007 (“ridiculously” high at 19.8%), when the capital base was half as high.

Only three sectors (semiconductors, defence-aeronautics and transport) have improved it in fifteen years. AlphaValue recalls that a return to pre-Covid-19 trends would mean a quarter drop in results in Europe. The world after is not tender.

To note

AlphaValue estimates that among the sectors that saw their returns on equity fall between 2007 and 2022, only capital goods and food and beverages are likely to improve them significantly in the future.

The former thanks to the energy transition which is boosting demand. The latter due to the slowdown in consolidation. By seeking to compensate for anemic consumption in Europe, this has often weighed on margins in the past.

How to react effectively to changes?

Economic uncertainties, political tensions, global warming, changing businesses and industries… The world is changing. How to decipher weak signals, anticipate and best adapt? The “Echos” editorial staff, with its 200 specialized journalists, provides you with strategic thinking tools every day to understand our environment and deal with changes. Through our analyses, surveys, chronicles and editorials, we support our subscribers to help them make the best decisions.