Posted Oct 2, 2022, 1:49 PM

Literature has made the musketeers bicker before their fraternization. But Atos did not even give the opportunity to the D’Artagnan of digital services, Onepoint. In two days, the board of directors, conscientiously applying the motto of “all for one”, unanimously rejected, with the end of the glove, an offer of 4.2 billion euros on a little less than half of the group, despite being 12% higher than the enterprise value of the whole.

It is true that between two morals of La Fontaine’s fables, investors hesitate. Wouldn’t the 400 million-income SME be the puny pécore wanting to be bigger than an ox twelve times its size, and what could burst 2.2 billion in debt to contract? The criticism was addressed, admittedly at different times, to Patrick Drahi and Altice. And on the French perimeter, the doubling in size that the merger with Evidian would imply has already been carried out twice by David Layani’s group in twenty years of existence.

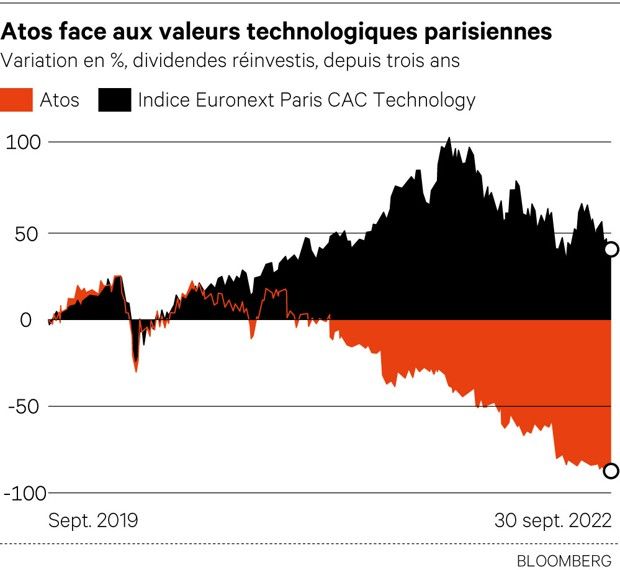

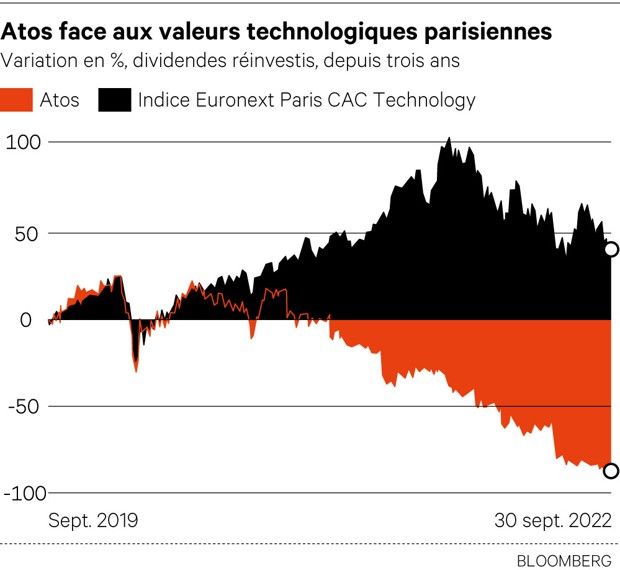

Isn’t Atos also this old lion of the fable, tired after three profit warnings, and who would need someone smaller than him to pull him out of the debt net? The operation would make the spin-off less risky and less dependent on lenders, but at the cost of giving up part of the value, which the board refuses. It’s heavy to digest, a musketeer’s hat…

The option of a return to better fortune

Onepoint’s offer, drawn up with the “private equity” fund ICG, which would be in the minority, would bring between a little less than one billion and 1.4 billion euros in cash to an Atos freed from its bank and bond debts and reduced by half of its social and legal liabilities, roughly the amount needed to recover Atos’ most traditional outsourcing activity.

If Atos retains 30% of the capital of a Onepoint-Evidian – which would correspond to the spin-off scheme providing for the stock split of 70% of Evidian -, it would obtain the bottom of this range, with the same option on the creation of value within a group intended to enter the stock market in the future.

Evidian was recently estimated at the beginning of September by Goldman Sachs analysts at 2.7 billion euros over a twelve-month horizon.

Their assessment is based on the current low cash generation of the structure bringing together the former digital transformation services and the Big Data and Security (BDS) division, i.e. 4.9 billion euros in turnover in 2021 generating a margin operational by 7.8%.

Based on multiples of operating results, these two branches forming Evidian are valued at around 7 billion euros by AlphaValue, if we attribute to them, as the spin-off plan does, all of Atos’ net debt. (2.95 billion).

What benchmarks in a constantly changing world?

Political uncertainties, scientific innovations, war in Ukraine, energy and ecological transition… How to understand these changes? How to position yourself? Every day, the 200 journalists from the “Echos” editorial staff help you decipher economic, political and international news through surveys, analyses, press reviews, chronicles and editorials. Our subscribers know that they can rely on these resources to better navigate our complex environment and make the best strategic decisions.