Posted Oct 3, 2022, 7:03 PMUpdated Oct 3, 2022, 7:35 PM

As the government prepares to unveil the outlines of its sobriety plan supposed to allow France to get through the winter without incident, the International Energy Agency (IEA) issues a warning to decision-makers , businesses and households on the Old Continent: “Gas savings will be crucial to deal with potential late cold spells in Europe”.

If the underground reserves are full of gas or almost in most countries of the Union, they risk melting very quickly if Russia were to cut off its supplies entirely – or worse, if deliveries of liquefied natural gas (LNG) were to come to be missed. Two scenarios that cannot be ruled out.

Asian competition to capture LNG

As recent suspicions of sabotage on the Nord Stream 1 and 2 gas pipelines have shown, betting on a resumption of Russian flows is becoming increasingly risky. “Russia delivered 140 billion m3 of gas to Europe in 2021, we should barely reach between 13 and 25 billion m3 in 2023 with current supply levels,” recalls Anne-Sophie Corbeau, researcher at the Center for Global Energy Policy at Columbia University.

On the LNG front, which has flowed into Europe like never before in recent months, several uncertainties also remain. Up 70% in Europe since the start of the year, LNG deliveries have benefited from less Asian competition. A parenthesis that could close if the weather becomes less clement.

“Japan, Korea or China have largely reduced their LNG imports since the start of the year because of excessively high prices, or even, for China, the impact of its “zero Covid” policy. These countries could be back if the winter were harsher than expected,” says Anne-Sophie Corbeau.

Also, the IEA calls for the urgent preservation of storage. “Our analysis indicates that gas storage capacities must be at least 33% full until the end of the heating season to ensure a safe and secure winter. “Below this threshold, “Europe could find it difficult to cope with a cold snap such as that of March 2018”, warns the international agency.

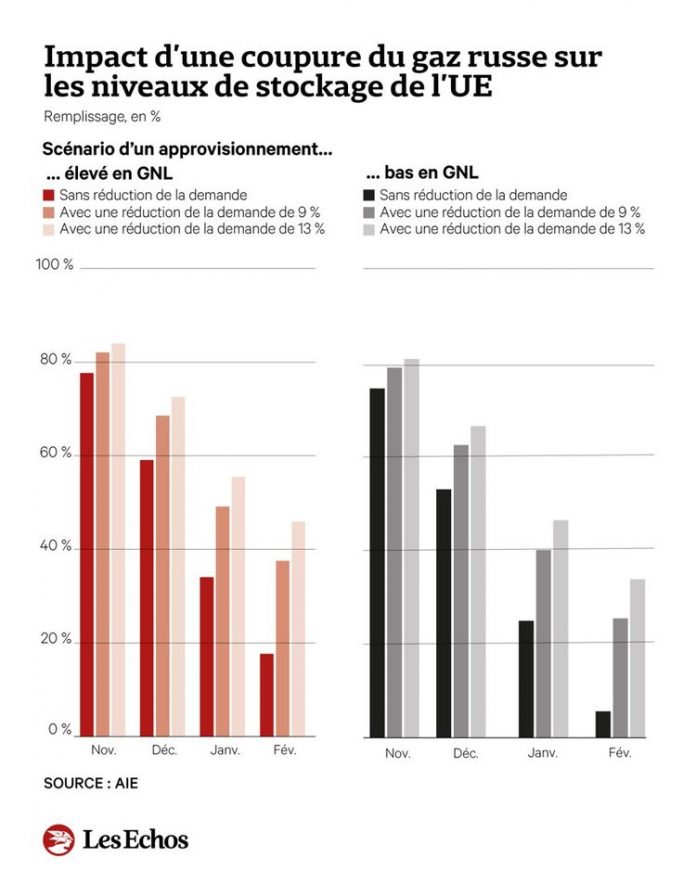

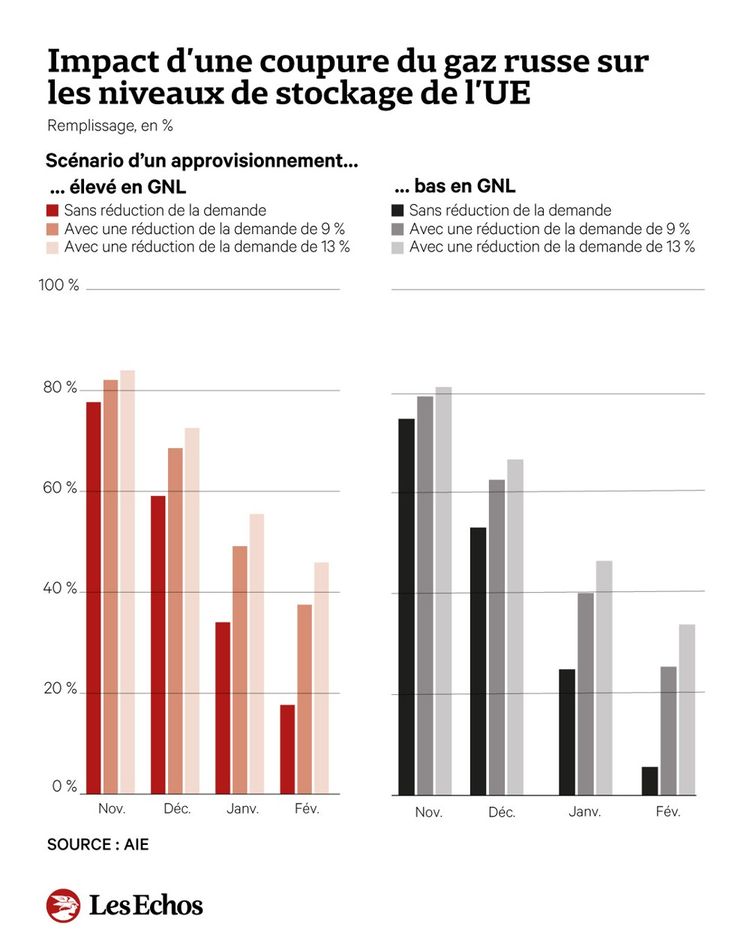

In concrete terms, the IEA estimates that a drop in gas demand of 9 to 13% is necessary in Europe until the end of winter, compared to average consumption observed over the past five years, to maintain storages outside this red line.

“Without a reduction in gas demand and if the Russian supply is completely cut off, the storages would be filled to less than 20% in February, assuming a high level of LNG supply” and “nearly 5% in the event low LNG supply,” warns the IEA.

The hardest part is yet to come

The effort required is of the same order of magnitude as that provided for in the European Commission’s plan, which provides for a 15% drop in consumption between August 2022 and the end of March 2023. And it is all the more crucial that the winter 2023-2024 will also be particularly risky for Europe. “Fuller storage means fewer gas injections during the summer of 2023 and less tension on the market”, also points out the international agency.

Europe has come a long way, but the hardest part is yet to come. According to the IEA, gas demand in Europe (OECD countries) fell by around 10% between January and August 2022. Among industrial consumers, we even reached a drop of 15% over the same period, considering given the forced reductions in production linked to the surge in gas prices.

But these reductions in consumption took place during a mild end of winter and during the summer period. “Nearly half of natural gas consumption by households and commercial consumers takes place in winter to heat buildings,” recalls the IEA. In addition, this year, the European electricity system will also rely much more than in the past on its gas turbines to produce electricity, the production of which is also at risk…